You just opened the email, saw the number, and realized: It’s happening. You are officially pre-approved.

It feels like you just won the lottery. You finally have the “ticket” to buy a home. You’re probably already mentally arranging furniture and picking out paint colors. But then, the adrenaline settles, and you’re left staring at the letter thinking, “Wait… what do I actually do with this?”

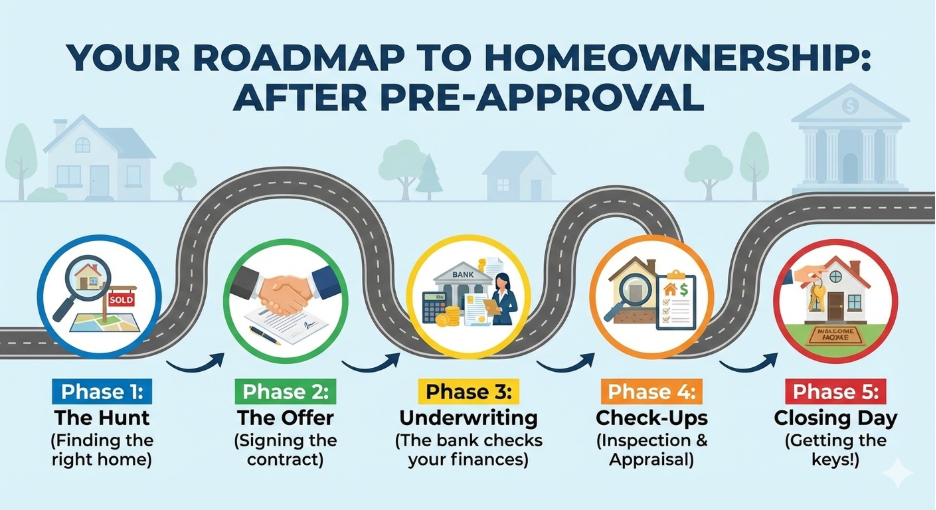

That specific moment, standing between the excitement of approval and the reality of buying, is where the real adventure begins. It’s not just about paperwork; it’s about navigating the gap between a promise from the bank and keys in your hand. So, let’s map out exactly what this journey looks like, step by step.

Your house hunt doesn’t start with browsing listings, it starts with setting your boundaries.

Now that you have your pre-approval letter, you know your maximum budget. But before you go to your first open house, here is a secret that banks won’t always tell you:

“Just because you can borrow $500,000, doesn’t mean you should.”

Your pre-approval amount is based on your gross income (before taxes).

It doesn’t account for your expensive hobbies, your grocery bill, or that

summer vacation you want to take.

Not sure what you can afford? Check out the CFPB’s guide on loan limits and budgets.

You found “The One.” It has the backyard you wanted and the perfect kitchen. Now, you have to win it.

Your agent will help you write a Purchase Agreement. This isn’t just a price tag; it’s a legal contract.

Think of this document as the official “rulebook” for the sale. It doesn’t just state the price; it outlines everything:

You will hear this term a lot. Earnest Money is a “good faith deposit”, usually 1% to 2% of the purchase price that you pay within days of your offer being accepted.

Read Investopedia’s deep dive on Earnest Money to understand exactly how it protects you.

Once your offer is accepted, your lender goes quiet. This is called Underwriting.

The Underwriter is the bank’s “detective“. Their job is to double-check everything to make sure you are a safe bet. This is the most fragile part of the process.

While you are in this phase, you must keep your financial life boring. Any big changes can change your “Debt-to-Income Ratio” and cause your loan to be denied days before closing.

Rule of thumb: If you have to ask, “Is this okay?”, call your loan officer first!

You hire an inspector to check the roof, plumbing, electric, and foundation.

The bank hires an appraiser to check the value of the home.

You made it! The inspection passed, the appraisal was good, and the underwriter has issued the magical words: “Clear to Close.”

By law, you must receive a document called the Closing Disclosure (CD) at least 3 business days before you sign.

On Closing Day: You will sign a mountain of paperwork (bring a comfortable pen!), transfer your down payment, and finally… get your keys.

The journey from pre-approval to closing typically takes 30 to 45 days. It’s a marathon, not a sprint.

It is completely normal to feel overwhelmed by the documents, the dates, and the “what-ifs.” But remember: thousands of people do this every day, and you can too.

Keeping track of deadlines, documents, and savings goals can be messy. That’s why we built Hyrise.

✅ Track Milestones: See exactly where you are in the process.

✅ Connect with Pros: Instantly connect with vetted real estate agents and lenders who know your local market.

✅ Stay Organized: Keep your savings goals and tasks in one place, so you never miss a beat.

Ready to close with confidence? Download the Hyrise App Today and let’s get you into that dream home.

Yes! Usually in 60 to 90 days. If you haven't found a home by then, your lender will just need to update your documents to re-issue it.

Please don't! Taking on new debt changes your financial profile and is the #1 reason loans get denied at the last minute. Wait until the house is yours.

On average, it takes 30 to 45 days to go from offer to closing, depending on how fast the inspection and underwriting go.

Hyrise Community Housing helps first-time buyers move from “where do I start?” to keys-in-hand. Learn the steps, plan your path, and connect with vetted pros all in one simple app.

Copyright © 2026 Hyrise | Powered by DevDefy | All Rights Reserved